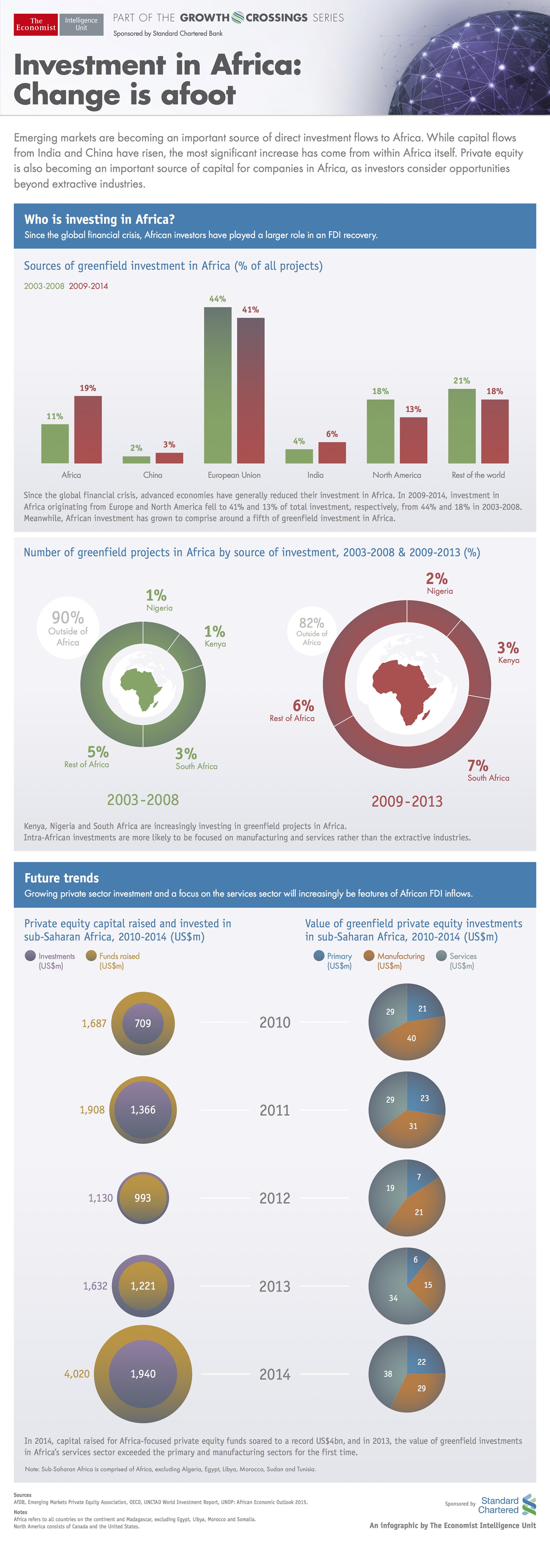

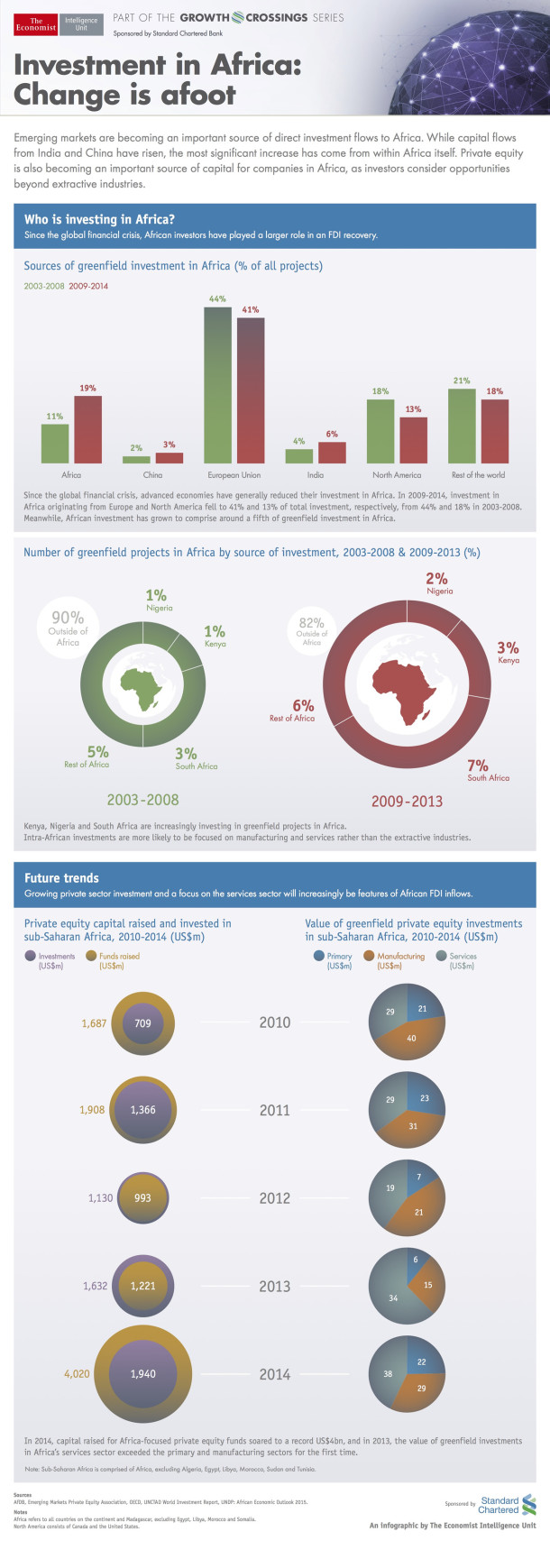

For many generations, Africa wasn’t the sort of place you wanted to invest in (unless you happened to be a resource grubbing colonist). In the 90’s and 2000’s there was a tremendous amount of aid that went to Africa, but for the most part, African nations didn’t have the sorts of markets that drew real investors: people hoping to fund development that would yield them a profit. As Africa, along with India and other large growing economy sets, developed into an undeniably “Developing” market, these investors found a spot in their portfolios. This has yielded much explosive growth in many regions of this massive continent. What’s more, as things have developed, much of the investment that has gone into these “Greenfield Projects” has come from within Africa itself, both from corporate and private equity. It’s a new day in Africa, and the changes are only going to become more pronounced. Here are some of the ways things are changing for Africa-specific investment.

Today 82% of the investment monies being spent within Africa come from outside of the country. While still the great majority, this is down 8% from five years ago, indicating that there is some serious capital to throw around. But where is it? Most of this money is coming from comparatively wealthy countries like Kenya, Nigeria, and South Africa.

Most of the money is being invested in either Services or Manufacturing, more signs that good things are having in Africa. While an infographic like this can only give a view from 30,000 feet, and saying good things are “happening in Africa” is nearly meaningless. Africa is a massive continent with many languages, cultures, climates, and economic situations. But what’s good for one region raises hope that investment will transform some of the long-depressed regions of Africa. It’s good for the African people, and it’s good for investors, more of whom are themselves African people.